DESIGN COLLABORATION: AGILE & CROSS-FUNCTIONAL TEAMS

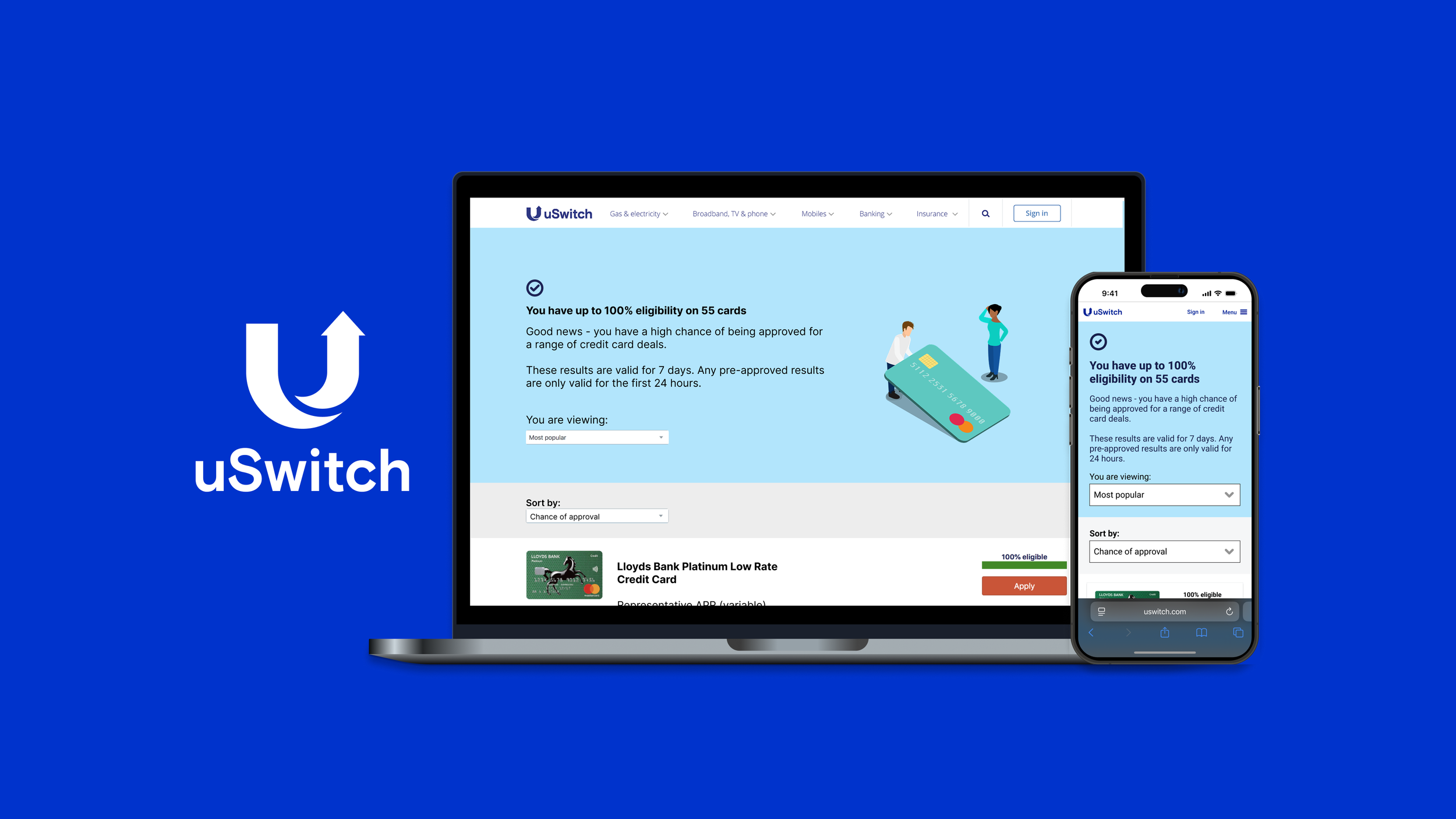

2 week sprint to launch credit card ‘Eligibility Checker’ V2

TEAM

2 Full Stack Developers, Content designer Data Scientist, Compliance lead and Product Lead

ROLE

Product Design Lead

KEY SKILLS

Workshop facilitation, Cross-functional collaboration, User testing, Prototyping, Stakeholder management, Validation with mettics

TOOLS

Figma, Whiteboard, Pen and Paper

Impact

+23% Conversion rate

-22% Bounce rate on results page

Established a new ‘cross-functional’ way of working

Embedded design thinking into the process

Problem

Context

Eligibility checker was recently launched and receiving a lot of traffic but we wanted to personalise the experience to be more useful for our users.

Problem Statement

Over 1,000 users a month were applying for credit cards they were not eligible for, this would likely negatively impact their credit score therefore giving a bad user experience on the uSwitch credit card site.

Why was this important?

Business goal

Reduce the amount of users applying for low eligibility credit cards therefore increasing our conversion rate.

User goal

Educate users on what to do if they had a lower credit score. Additionally if possible direct users with lower credit scores to products that they were more likely to be eligible for.

Process

Discover

It had come to light in our weekly meeting that over 1,000 users a month were applying for credit cards that they were very unlikely to be approved for (0-10% eligibility rating). Our business model relied on users being accepted for cards in order to generate revenue. We decided as a team that this was a problem we wanted to solve.

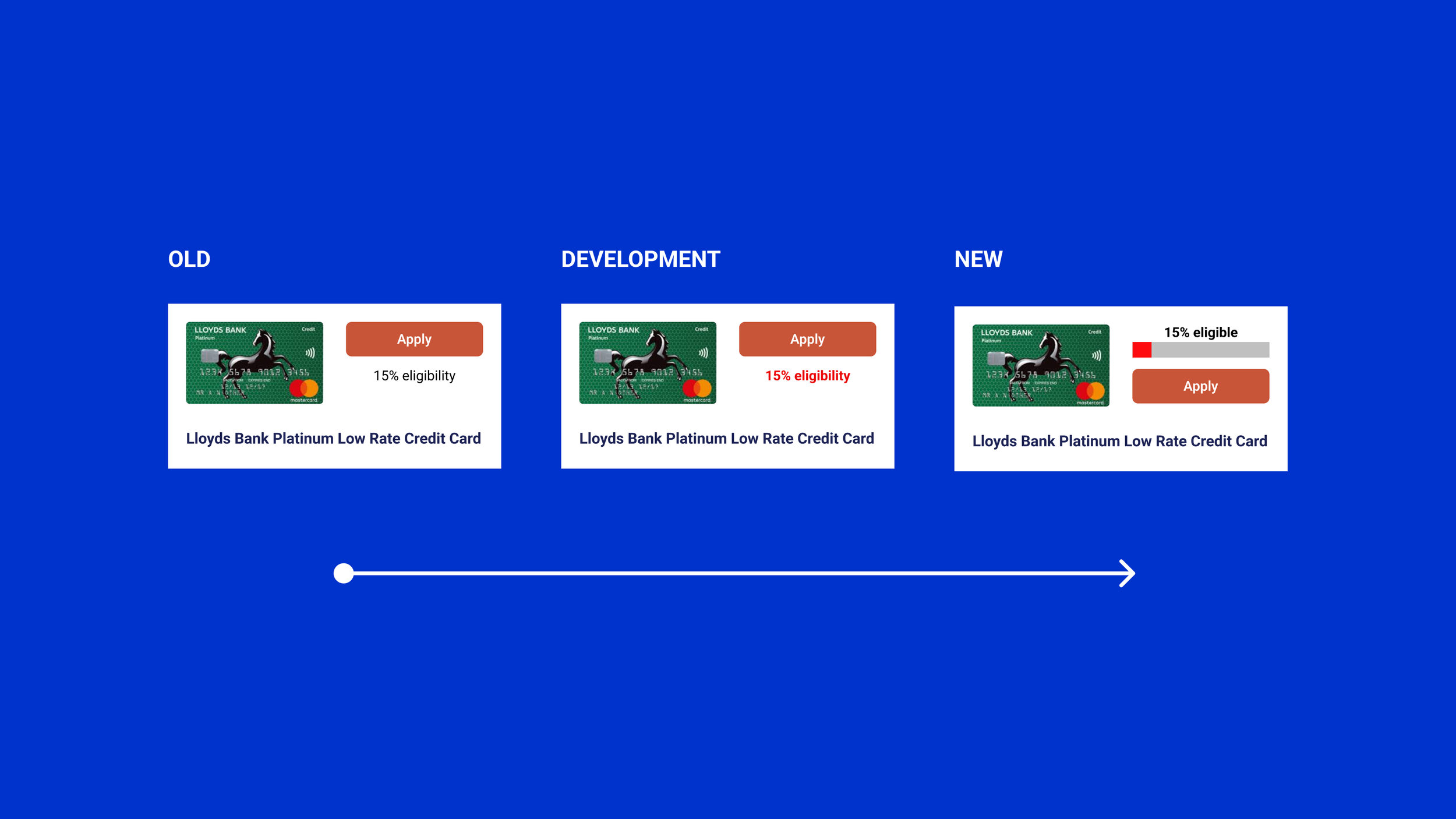

OLD DESIGN

Over 1,000 users each month were applying for a credit card with a 0-10% eligibility rating.

Google analytics: Funnel analytics

We had a kick-off session around the issue that had been raised. I suggested we used a Sprint approach to work as a team cross-functionally around a problem and the team agreed We decided to work on this over 2 weeks as the team had other commitments during the week:

SPRINT APPROACH & CUSTOMER INTERCEPTS

USER INTERCEPT FINDING

Most users were unaware that being rejected for a credit card would likely negatively impact their credit score.

THE PLAN

DAY 1 +2

🎯

Make a map and choose a target

DAY 3 + 4

✏️

Sketch competing solutions

DAY 5 + 6

👇🏼

Decide on the best

DAY 7 + 8

🔨

Build a realistic prototype

DAY 9 + 10

🧪

Test with target customers

Define

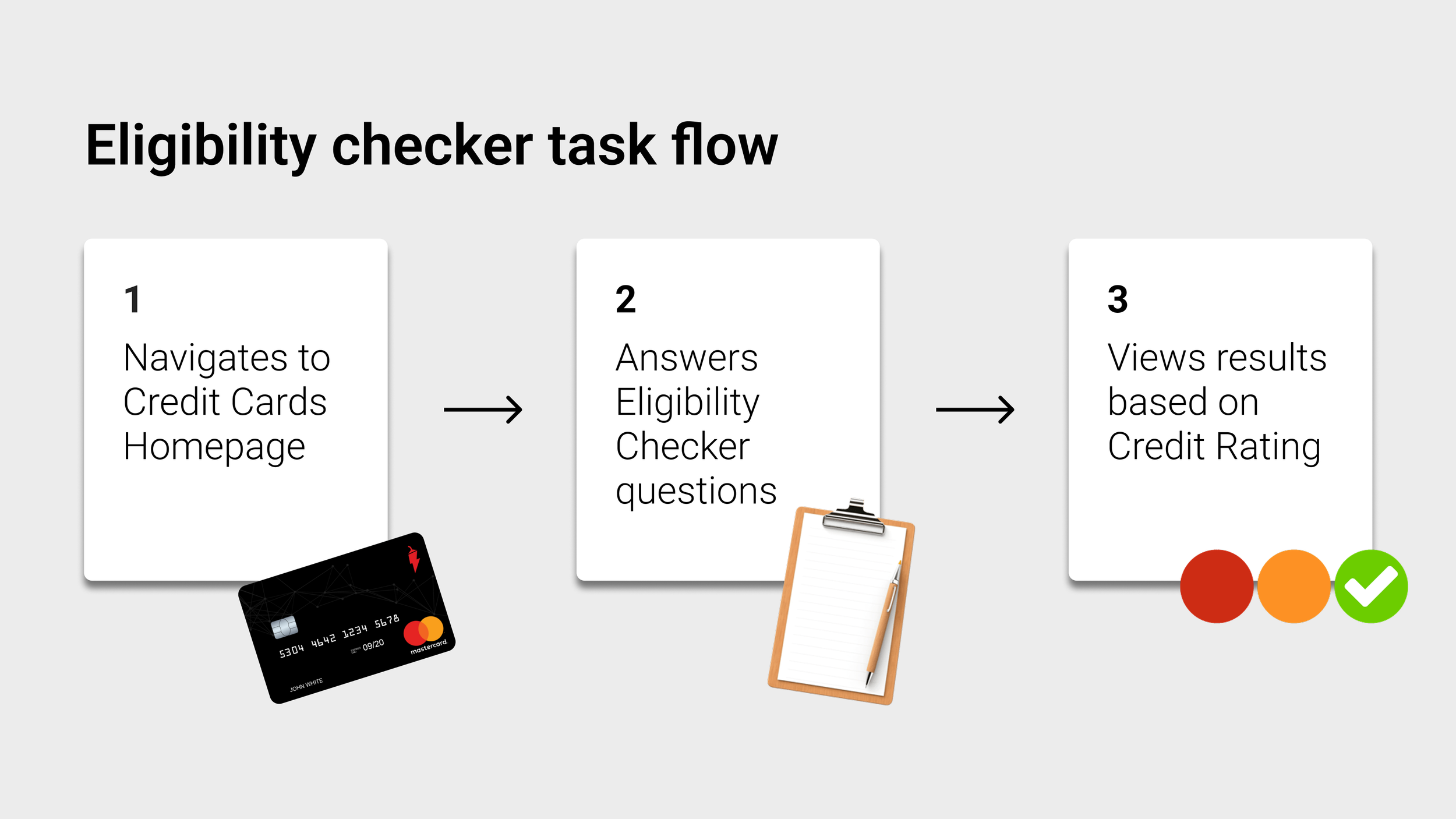

The eligibility checker flow had 3 main steps. The credit card results that were shown based on the eligibilty of that user. Therefore we decided to segment the users based on those results that were linked to the credit history.

CHOOSING A TARGET: SEGMENTING THE USER GROUP

3 USER GROUPS BASED ON ELIGIBILITY:

Stop and Learn

(0-10%) <- THE TARGET

Pause and consider

(11 - 40%)

Continue and choose

(41% -100%)

Ideate

We agreed as a team that the messaging would be key to the success of the test at the end of the sprint. Therefore I collaborated heavily with content designers and compliance to develop designs and messaging. Sketched out ideas as a team, decided on a route that would a summary message at the top and develop a visualise to represent the eligibilty rating.

HOW MIGHT WE?

Colour code the button or graphic to match eligibility?

Show results to users that only had 15% of less eligible cards?

What content could we create to support users?

How might we introduce the results to users with a summary?

SKETCH COMPETING SOLUTIONS: MESSAGING

Prototype & Test

We kept the design changes as small as we could to deliver the impact and therefore decided to code a prototype that we could push live to test in the lab.

Testing using our on site user lab with viewing room.

USER INSIGHTS FROM TESTING

INSIGHT 1

Users unsure why they were seeing results that they had a very low eligibility for.

INSIGHT 2 (CONFIRMED):

Users were unaware that being rejected would likely negatively impact their credit score.

INSIGHT 3

Users wanted more support and advice from uSwitch as a brand.

Develop

Based on the feedback from users we changed four elements in the design:

Stop and pause message to guide users and educate

Results organised by highest eligibility first

Adapted results intro message with icon to summarise the user results

Colour coded % bar above CTA to bring clarity before applying

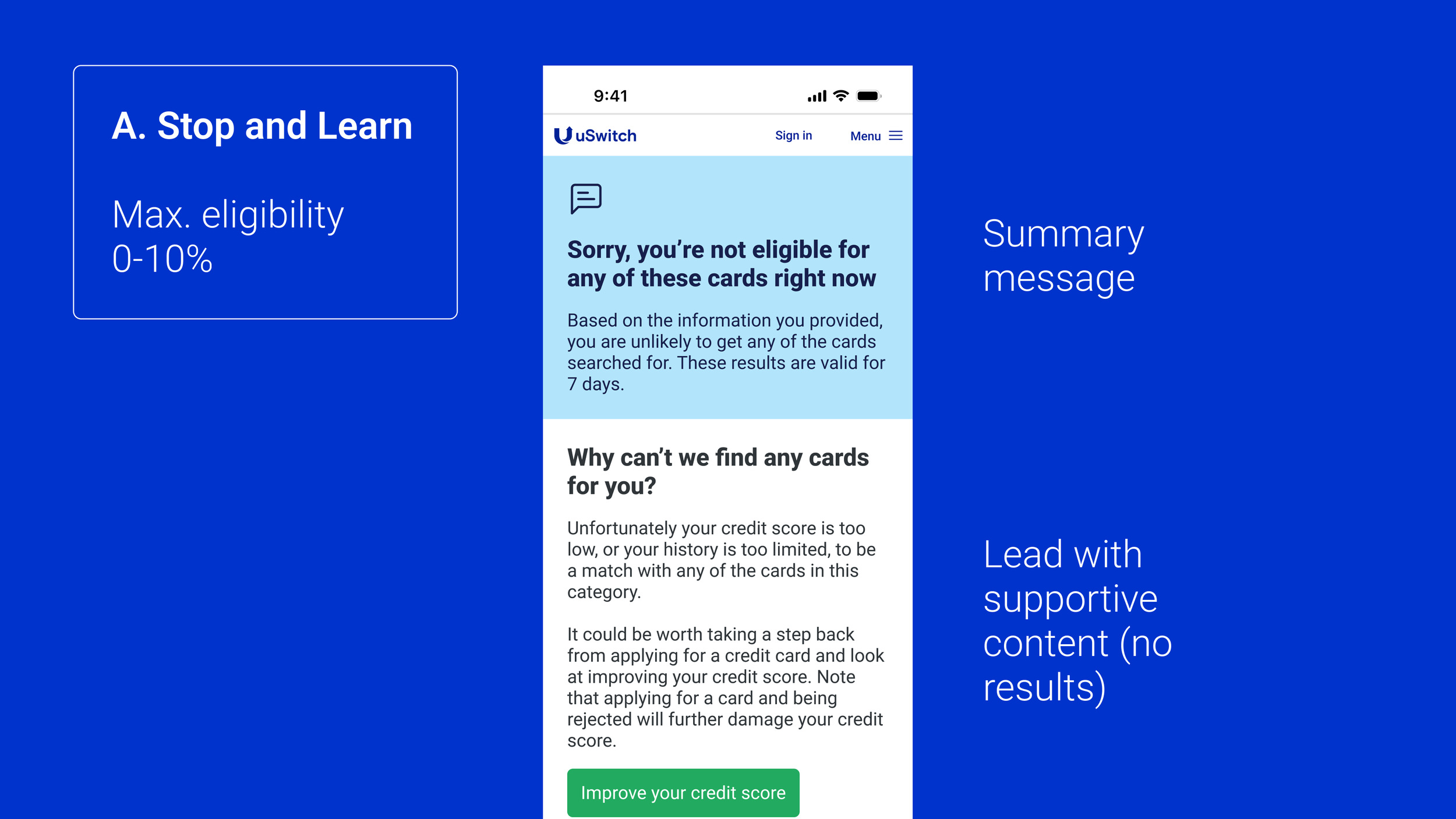

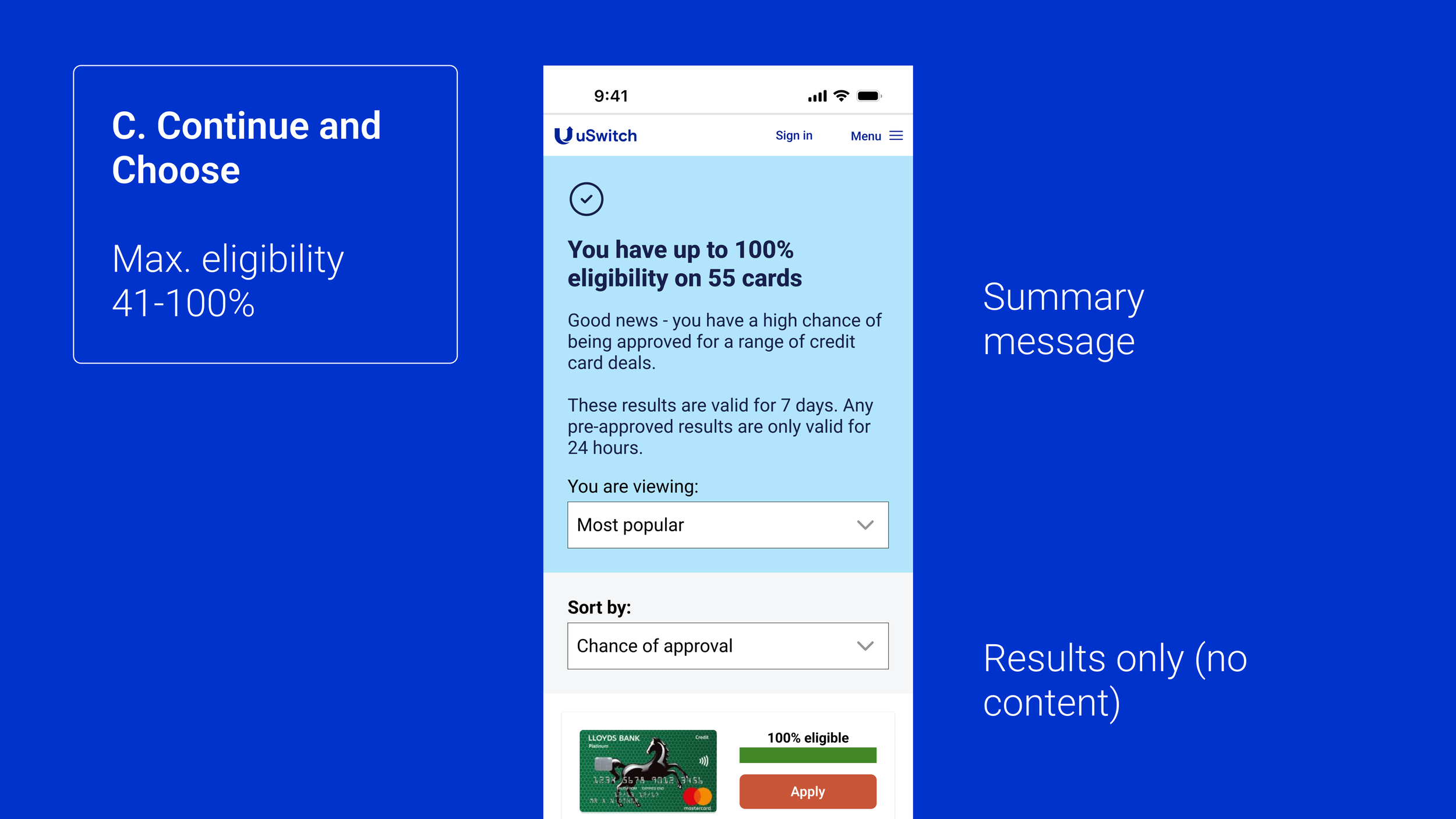

3 DESIGN OPTIONS FOR 3 USER GROUPS

A. STOP AND LEARN

No results shown under 11% eligibility

Show message to explain why there are no results

Link to content about how to improve credit score

B. PAUSE AND CONSIDER

Show results from 40% to 11% eligibility

Show message under first result to explain that it might be worth taking a step back

Orange eligibility bar to highlight lower eligibilty

C. CONTINUE AND CHOOSE

Show results from 100% down to 11%

Show updated legibility bar with coloured bar

No content shown to these users

Validate

After testing and making design developments we pushed live to 5% of our audience and monitored the funnel and traffic. The results were encouraging so we pushed live to 100% of our user base on the following Monday morning.

Launch

After rolling out to 100% of our users on the Monday morning and then again monitored traffic. The numbers were better than we thought and positively impacted both users and our approval rate which was a win win. We also developed a new way of working as a team and the feedback was that we wanted to continuing doing this at a regular cadence.

FINAL DESIGNS

Impact

+23% Conversion rate

-22% Bounce rate on results page

Established a new ‘cross-functional’ way of working

Embedded design thinking into our process

COLLABORATION

“This was the best project I was part of at uSwitch. We were able to own a specific problem in the customer journey. The whole team rallied together to create a solution quickly and could continue to iterate on it in a true agile fashion. “

Lead Developer, uSwitch

Other projects